what is suta taxable

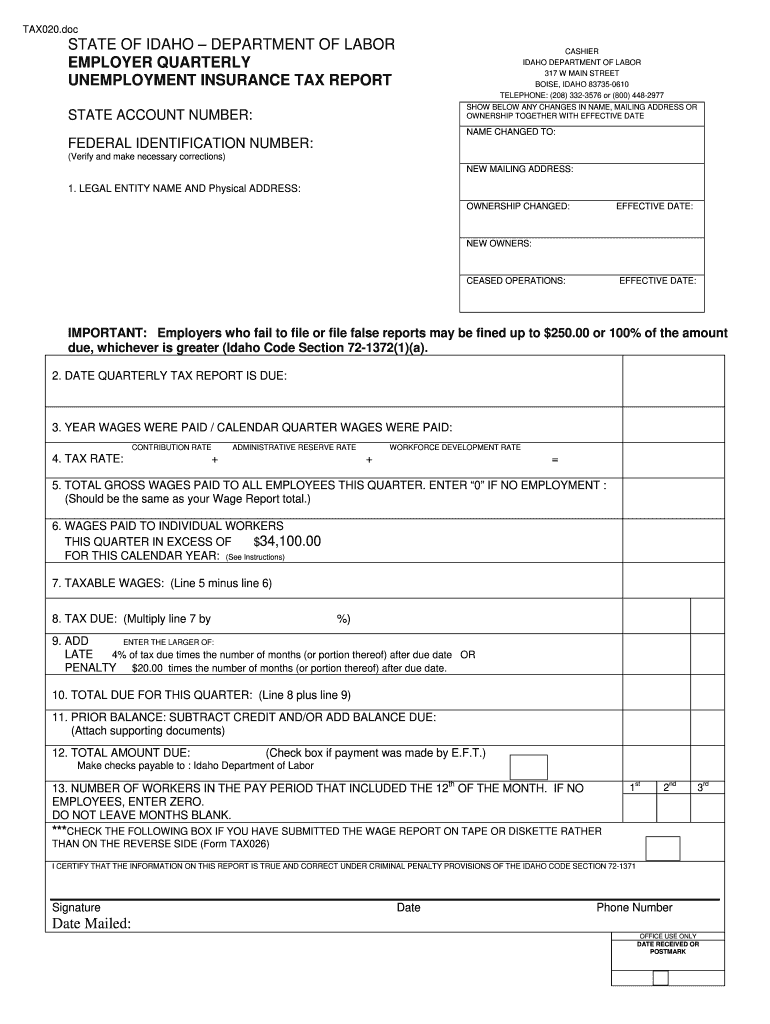

The State Unemployment Tax Act commonly referred to as SUTA tax is a state unemployment insurance program requiring employers to pay towards a fund. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays.

Understanding State Unemployment Tax Authority Suta

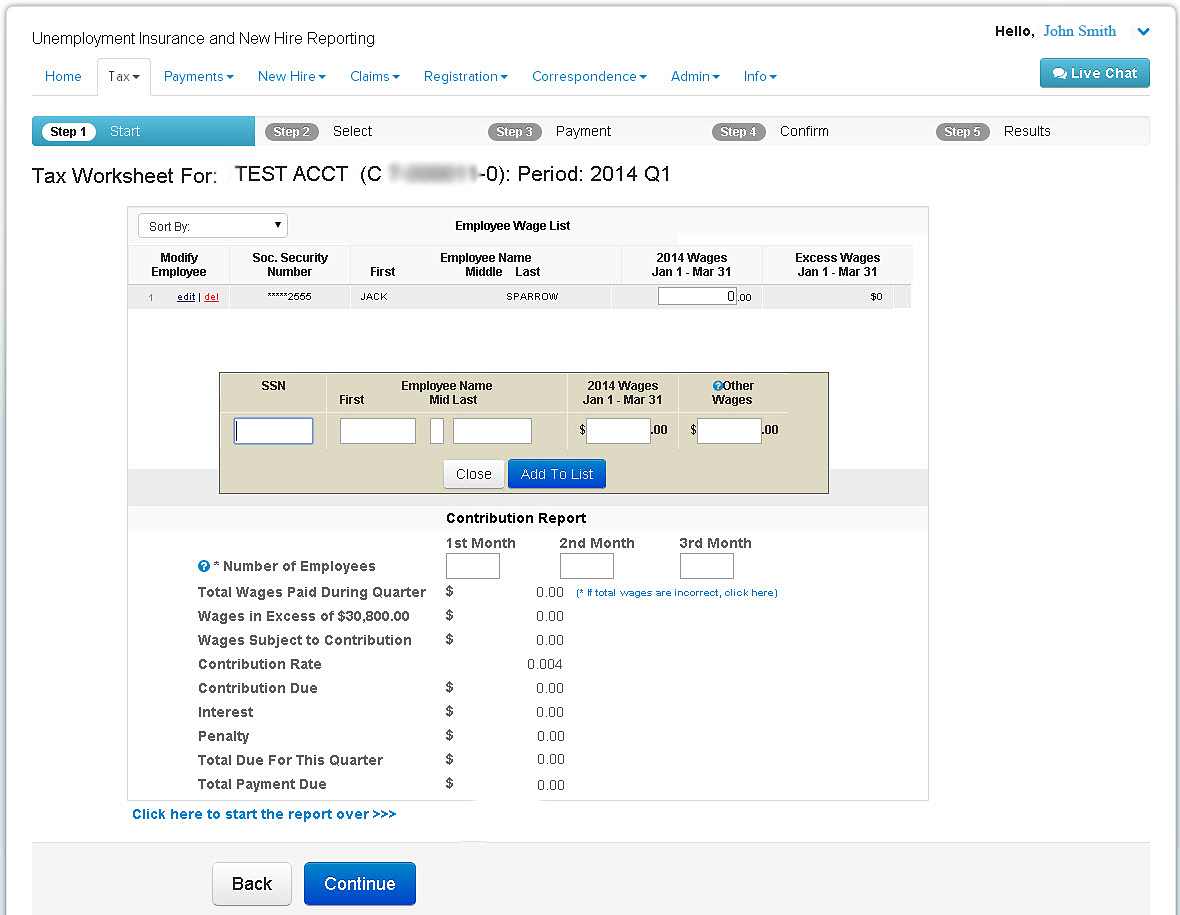

Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account.

. The State Unemployment Tax Act SUTA tax is typically a payroll tax paid on employee wages by all employers. Federal Unemployment Tax Act - FUTA. The FUTA tax rate is a flat 6 but is reduced to just.

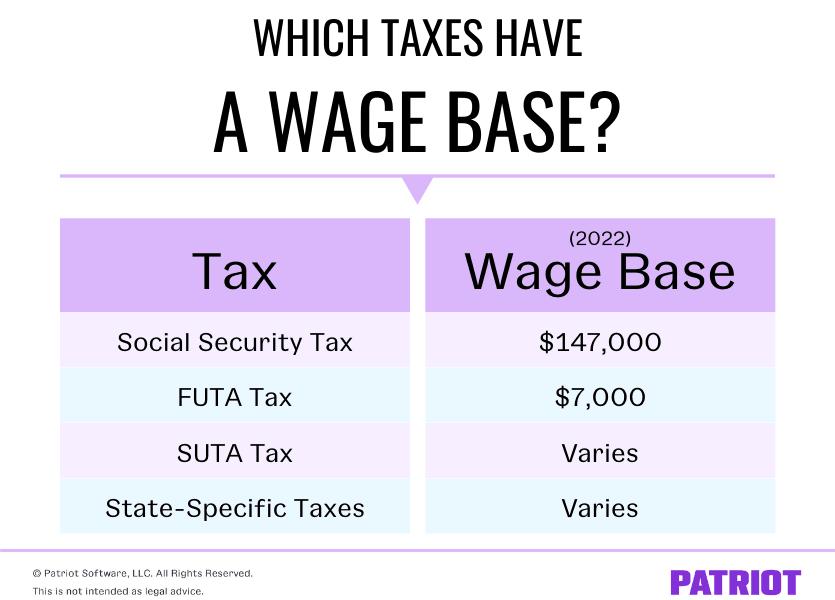

State taxes vary including the State Unemployment Tax Act SUTA contribution rates. 0010 10 or 700 per. In some cases however the employee may also have to pay.

The original legislation that allows the federal government to tax businesses with employees for the purpose of collecting revenue. It is a payroll tax that goes towards the state unemployment fund. It is a payroll tax that goes towards the state unemployment fund.

State Unemployment Tax Act is also known as SUTA state unemployment insurance and SUI. The Assessment Board at OESC will hear cases concerning employer unemployment tax accounts such as. Some states apply various formulas to determine the taxable wage base.

Employer contribution rates whether a worker is an independent contractor. The responsibility of SUTA compliance falls to those in charge of company payroll and payments are most commonly made in quarterly installments. The states SUTA wage base is 7000 per.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. The tax rates are updated periodically and might increase for businesses in certain. Indian tribe or tribal unit.

You should be aware of current rates and understand how the tax is calculated. The current taxable wage base that Arkansas employers are required by law to pay unemployment insurance tax on is ten thousand dollars 10000 per employee per calendar. Liable for federal unemployment tax.

The FUTA and SUTA taxes are filed on Form 940 each year regardless if a business has an employee on unemployment insurance. File Wage Reports Pay Your Unemployment Taxes Online. State county city or joint governmental unit.

Previously liable for reemployment tax in the State of Florida. You can get tax rate information and a detailed listing of the individuals making up the three-year total of benefit chargebacks used in your Benefit Ratio online or by phone fax email or postal. What are SUTA taxes.

The SUTA tax is a type of payroll tax deducted from paychecks and remitted to the governmentIn the case of the state unemployment tax this is a deduction made by employers. The amount of tax.

What Is A Wage Base Taxes With Wage Bases More

How Line 10 On Form 940 Is Calculated

State Unemployment Tax Act Suta Bamboohr

Suta Tax An Employer S Guide To The State Unemployment Tax Act

Garrison Shops Had A Suta Tax Rate Of 3 7 The State S Taxable Limit Was 8 000 Of Each Employee S Brainly Com

Utah Unemployment Insurance And New Hire Reporting

Dor Unemployment Compensation State Taxes

Solved The Following Information Pertains To A Weekly Payroll Of Fanelli Fashion Company A The Total

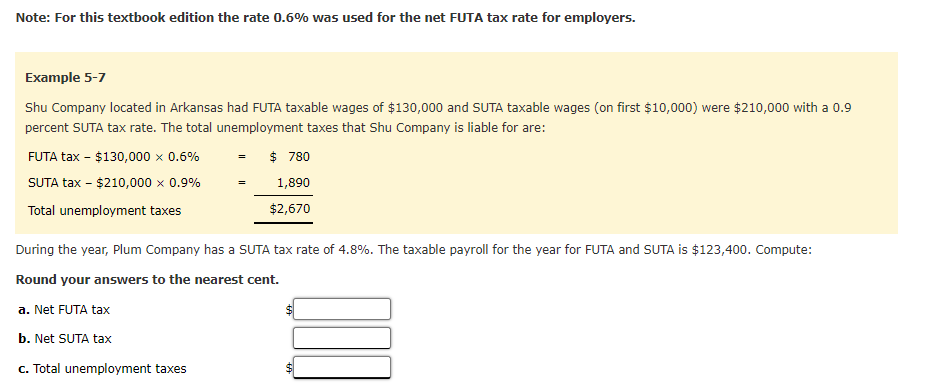

Solved Note For This Textbook Edition The Rate 0 6 Was Chegg Com

What Is Suta What Your Business Needs To Know Advapay Systems

Suta Tax Requirements For Employers State By State Guide

Futa Calculation During The Year Zeno Company Has A Suta Tax Rate Of 6 3 The Taxable Payroll For The Year For Futa And Suta Is 77 000 Compute A Course Hero

Suta State Unemployment Taxable Wage Bases Aps Payroll

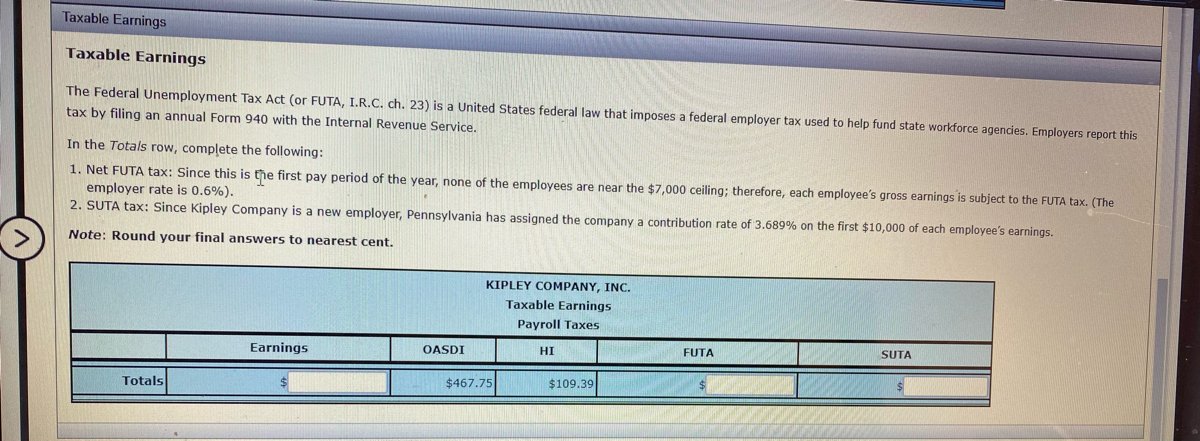

Answered Taxable Earnings The Federal Bartleby

What Is Suta Tax And Who Pays It